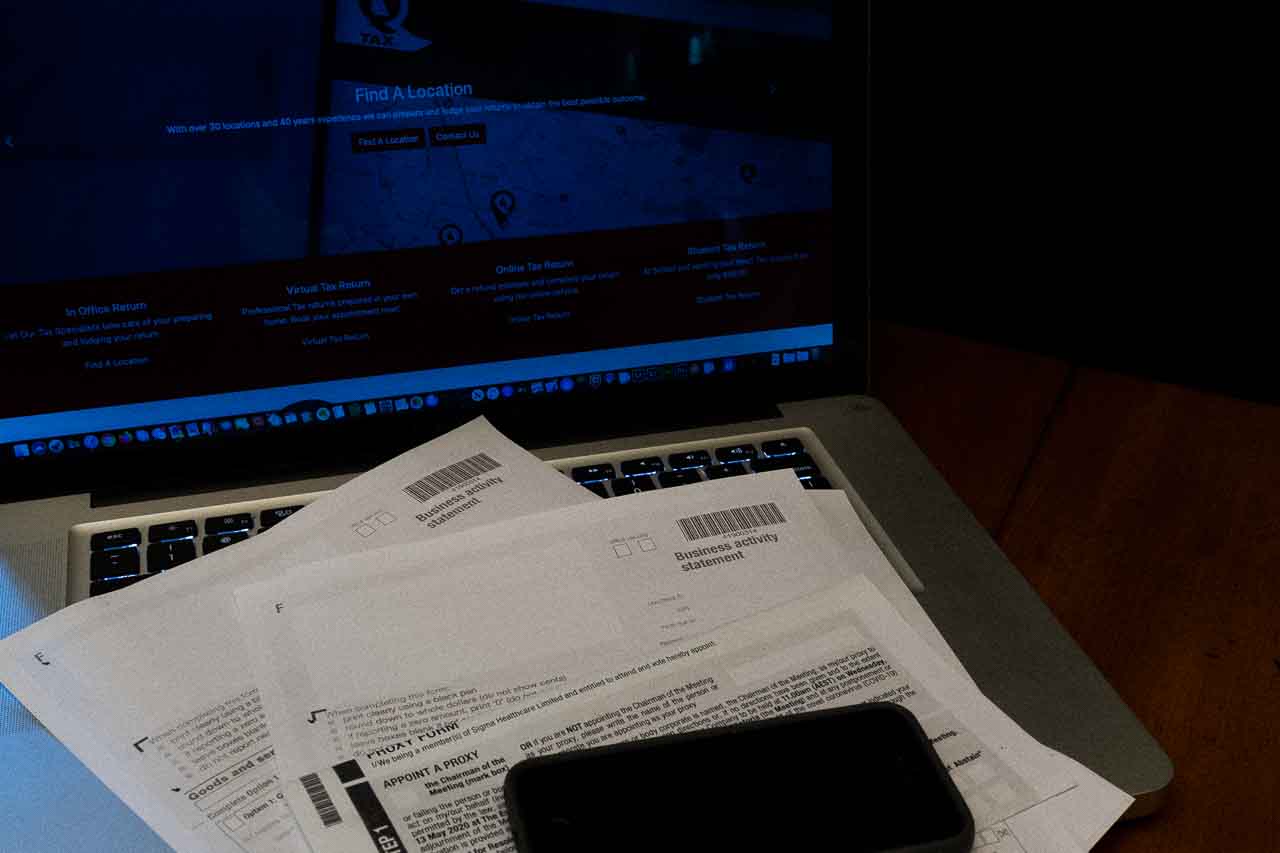

Partnerships Business Activity Statements

As a member of a partnership you need to ensure that your partnership Business Activity Statements (BAS) will be lodged with the Australian Tax Office (ATO) either monthly or quarterly and these figures need to be reconciled with your annual taxation return to ensure that your recordkeeping is up to scratch. QTAX is here to help you get you BAS and Tax returns completed accurately so that you can minimise any issues caused by discrepancies. For your partnership to be eligible for GST credits and BAS reporting you need to ensure you have your ABN and that your Partnership is GST registered, you can optionally register even if you do not meet the turnover threshold, please discuss with us the benefits of doing so in your particular circumstance. QTAX are able to help you with your ABN application and also you GST registration to ensure that you are fully compliant as well as formalising your partnership arrangements to make them a legal partnership as viewed by the ATO. Remember, QTAX are here to help you as required, QTAX Making Tax Easy.