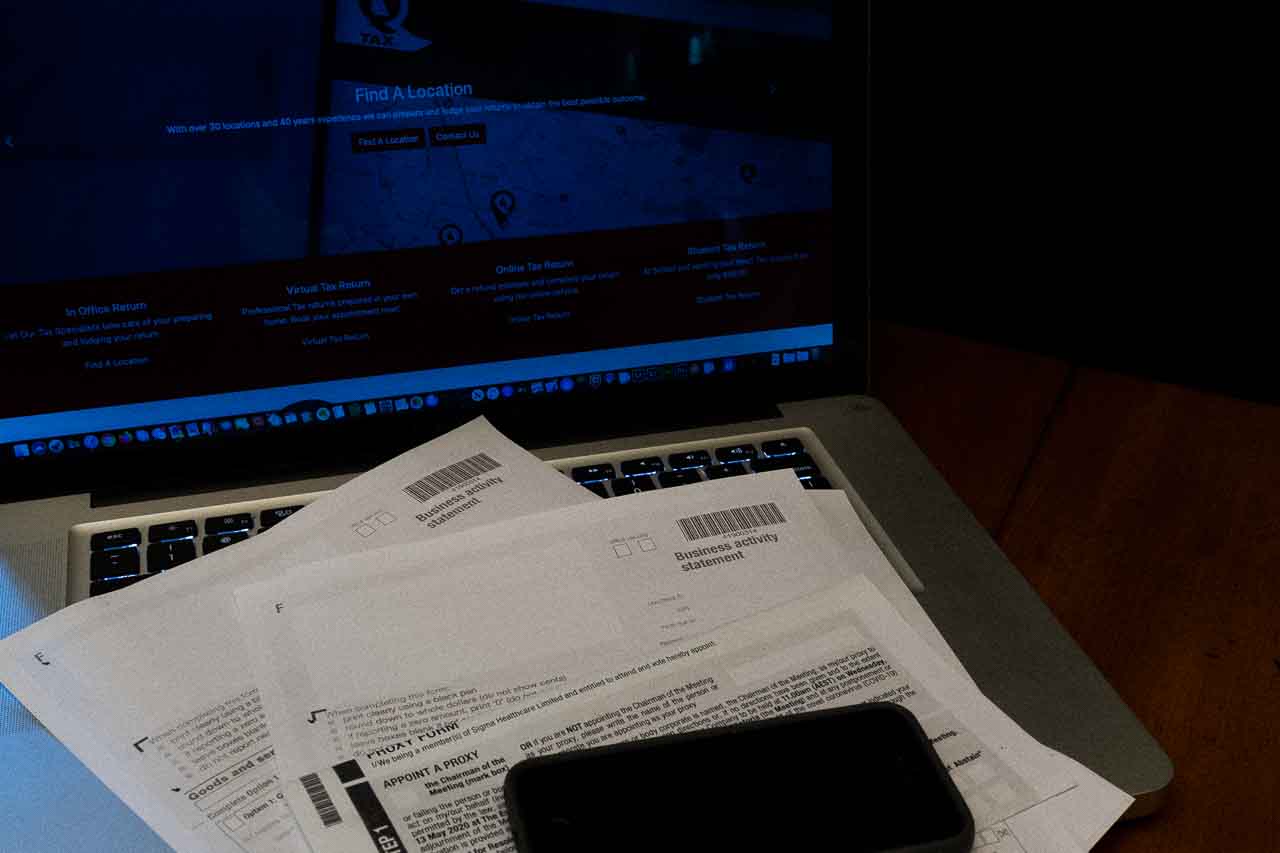

Trust Business Activity Statements

If you operate a Trading trust you may be required to register for GST and even if you do not meet the registration threshold there may be benefits that arise from voluntary registration. As an individual trustee or as a company official of the trustee corporation you have the obligation to ensure that your trust is operating within the rules and regulations defined by the legislation that your Business Activity Statements (BAS) need to be lodged with the Australian Tax Office (ATO) either monthly or quarterly. These reported figures need to be reconciled with your annual taxation return to ensure that your recordkeeping is up to scratch and you are meeting your obligations QTAX is here to help you get you BAS and Tax returns completed accurately so that you can minimise any issues caused by discrepancies; we can also assist with all of your bookkeeping requirements. Remember, QTAX are here to help you as required, QTAX Making Tax Easy.

inimum of hassle. Remember, QTAX are here to help you as required, QTAX Making Tax Easy.